COMMERCIAL AUTO

Commercial auto insurance is designed to protect vehicles used for business purposes. It provides coverage for physical damage to vehicles, liability for third-party bodily injury or property damage, and various other risks that businesses face when using vehicles in their operations. This type of insurance is essential for businesses that rely on vehicles for tasks such as transporting goods, making deliveries, providing services, and more.

GENERAL LIABILITY

General liability insurance is designed to protect businesses from a variety of liability risks. It provides financial protection in the event that a business is held responsible for bodily injury, property damage, or other third-party claims arising from its operations, products, or premises. This insurance is essential for businesses as it helps cover legal expenses, settlements, and judgments that may result from such claims.

WORKERS COMP

Workers compensation is a type of insurance that provides benefits to employees who are injured or become ill as a result of their job. It is designed to protect both employees and employers by providing financial assistance and support in the event of work-related injuries or illnesses. Employers are protected from, what could be, costly lawsuits while ensuring that injured employees receive the necessary support that they need.

COMMERCIAL AUTO

Commercial auto insurance is designed to protect vehicles used for business purposes. It provides coverage for physical damage to vehicles, liability for third-party bodily injury or property damage, and various other risks that businesses face when using vehicles in their operations. This type of insurance is essential for businesses that rely on vehicles for tasks such as transporting goods, making deliveries, providing services, and more.

GENERAL LIABILITY

General liability insurance is designed to protect businesses from a variety of liability risks. It provides financial protection in the event that a business is held responsible for bodily injury, property damage, or other third-party claims arising from its operations, products, or premises. This insurance is essential for businesses as it helps cover legal expenses, settlements, and judgments that may result from such claims.

WORKERS COMP

Workers compensation is a type of insurance that provides benefits to employees who are injured or become ill as a result of their job. It is designed to protect both employees and employers by providing financial assistance and support in the event of work-related injuries or illnesses. Employers are protected from, what could be, costly lawsuits while ensuring that injured employees receive the necessary support that they need.

Quick Quote Form

We're excited to announce that our CSLB promotion is active, providing special rates for licensed contractors in California!

Commercial Auto

Commercial auto insurance is designed to protect vehicles used for business purposes. It provides coverage for physical damage to vehicles, liability for third-party bodily injury or property damage, and various other risks that businesses face when using vehicles in their operations. This type of insurance is essential for businesses that rely on vehicles for tasks such as transporting goods, making deliveries, providing services, and more.

Lawsuits/Legal Fees

Property Damage

Medical Bills

Theft And Vandalism

General Liability

Contractor General Liability Insurance offers financial protection to contractors, covering the obligations they may be required to pay for damages or medical expenses resulting from bodily injury, property damage, or personal/advertising injury. Maintaining this coverage is highly advised for contractors, not only to safeguard their own interests but also because many projects demand proof of such insurance for acceptance.

Property Damage

Bodily Injury

Personal/Advertising Injury

Completed Operations Liability

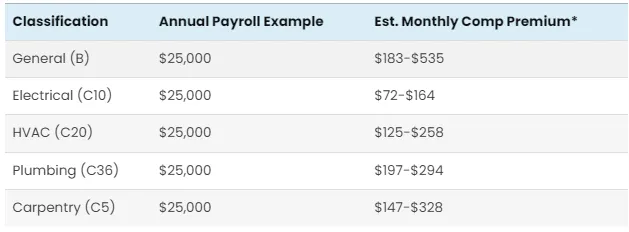

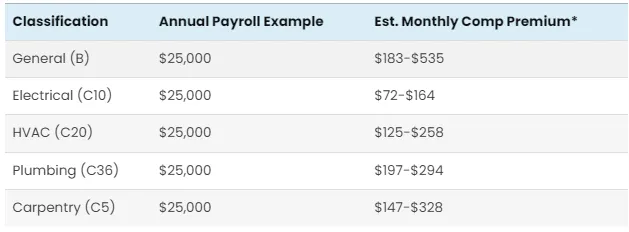

Workers Comp

If an employee sustains an injury, falls ill, or experiences a fatal incident due to work-related reasons, the workers’ compensation policy will provide necessary benefits to the affected employee or their family. These benefits may encompass medical care, temporary or permanent disability benefits, partial wage replacement, and death benefits.

The workers’ compensation policy also extends coverage to the contractor. In the event that an employee receives compensation through the workers’ comp policy, they are not allowed to file a lawsuit against the contractor.

Medical Care

Disability Benefits

Wage Replacement

Death Benefits

Commercial Auto

Commercial auto insurance is designed to protect vehicles used for business purposes. It provides coverage for physical damage to vehicles, liability for third-party bodily injury or property damage, and various other risks that businesses face when using vehicles in their operations. This type of insurance is essential for businesses that rely on vehicles for tasks such as transporting goods, making deliveries, providing services, and more.

Lawsuits/Legal Fees

Property Damage

Medical Bills

Theft And Vandalism

General Liability

Contractor General Liability Insurance offers financial protection to contractors, covering the obligations they may be required to pay for damages or medical expenses resulting from bodily injury, property damage, or personal/advertising injury. Maintaining this coverage is highly advised for contractors, not only to safeguard their own interests but also because many projects demand proof of such insurance for acceptance.

Property Damage

Bodily Injury

Personal/Advertising Injury

Completed Operations Liability

Workers Comp

If an employee sustains an injury, falls ill, or experiences a fatal incident due to work-related reasons, the workers’ compensation policy will provide necessary benefits to the affected employee or their family. These benefits may encompass medical care, temporary or permanent disability benefits, partial wage replacement, and death benefits.

The workers’ compensation policy also extends coverage to the contractor. In the event that an employee receives compensation through the workers’ comp policy, they are not allowed to file a lawsuit against the contractor.

Medical Care

Disability Benefits

Wage Replacement

Death Benefits

Copyright © 2023 Remedy Financial & Insurance Services. All rights reserved.